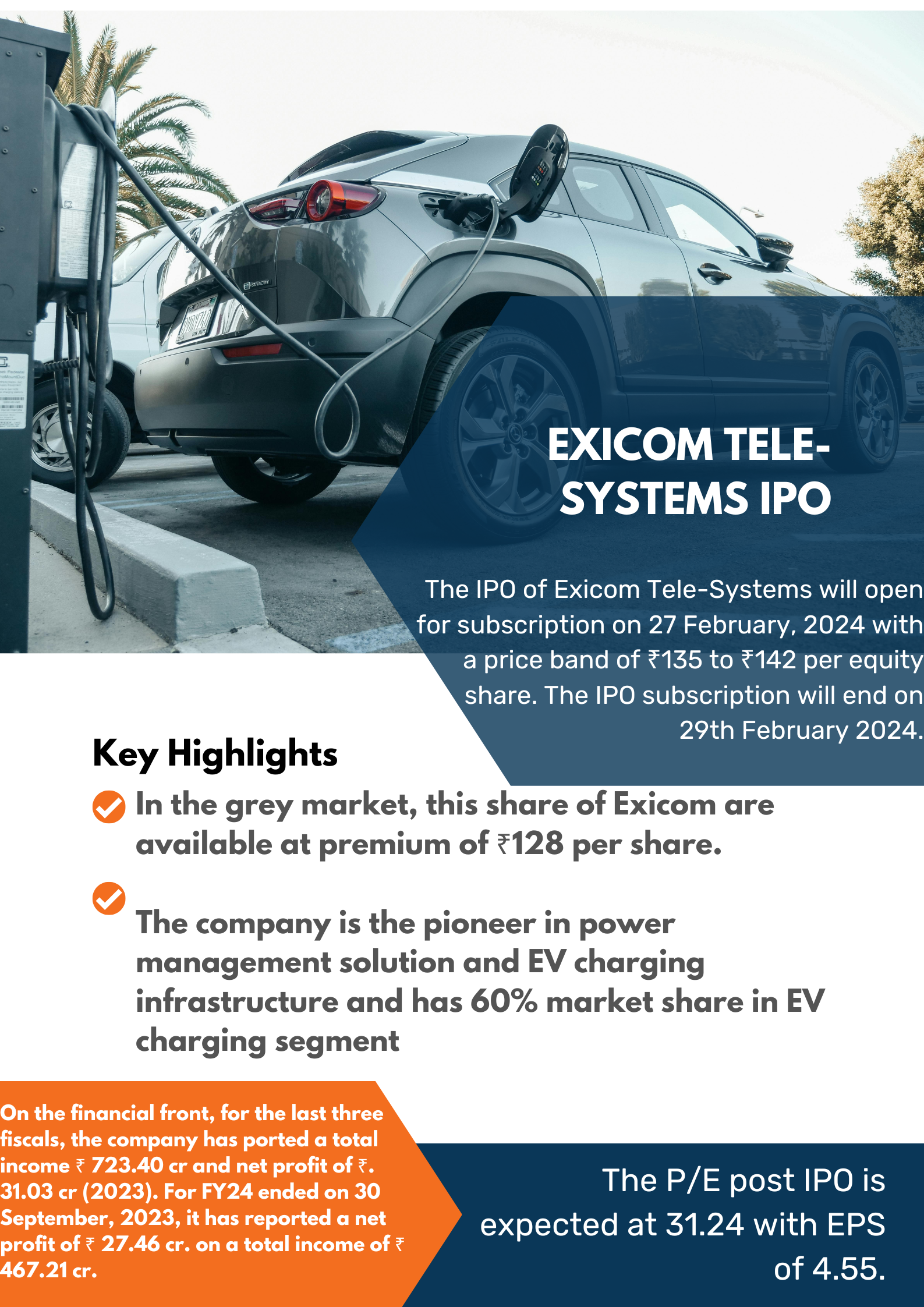

Exicom Tele-Systems IPO is a India based power management solution provider incorpoated in 1994, operating in designing, manufacturing and servicing of DC Power Systems,digital communcation networks and electric vehicle supply equipment especially EV Charging equipments.Exicom Tele-Systems is the pioneer in the EV service market. The IPO of Exicom Tele-Systems will open for subscription on 27 February, 2024 with a price band of ₹135 to ₹142 per equity share. The IPO subscription will end on 29th February 2024.

Exicom Tele-Systems IPO will be raising 429 crore from this public issue out of which ₹329 crore is aimed through the issuance of fresh issues. Around ₹100 crore is reserved for Offer for Sale. One lot will comprise of 100 shares and the allotment of shares will be done by 1st March 2024. The initiation of refund will happen on 4th March, 2024 and credit of shares in Demat will happen on 4th March, 2024. The market capitalization of Exicom Tele-Systems is ₹ 1715.71 Cr with an ROE of 13.38% and ROCE of 10.92%.

75% of the net issue is open for QIB Investors, 15% for HNI’s and 10% to Retails Investors.

In the grey market, this share of Exicom are available at premium of ₹128 per share.

Link Intime India Limited will be the official registrar of the book building issue.The final listing of Exicom Tele-Systems is expected on 5th March 2024.

The company will be utilizing the Net Proceeds towards funding the following objects:

Part-financing the cost towards setting up production/assembly lines at the planned manufacturing facility in Telangana

Repayment/pre-payment, in part or full, of certain borrowings of the company

Investment in R&D and product development

Part-funding incremental working capital requirements

General corporate purposes

On the financial front, for the last three fiscals, the company has ported a total income ₹ 723.40 cr and net profit of ₹. 31.03 cr (2023). For FY24 ended on 30 September, 2023, it has reported a net profit of ₹ 27.46 cr. on a total income of ₹ 467.21 cr.

The P/E post IPO is expected at 31.24 with EPS of 4.55.

The company is the pioneer in power management solution and EV charging infrastructure and has 60% market share in EV charging segment and is ready for bright prospects ahead with shift from conventional fuel to EV vehicles globally.